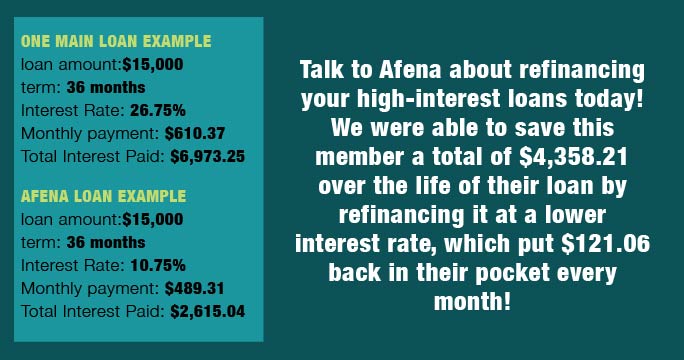

if you have a high-interest loan at a finance company like One Main Financial or Mariner Finance,1 you may be able to save thousands by refinancing at Afena…

Finance companies like One Main and Mariner Finance1 exist for one reason: to make as much money from their customers as possible. They promise fast and easy loans for anyone, but what they really do is charge you thousands of additional dollars to borrow money at a higher interest rate than you deserve.

We know our members deserve SO MUCH BETTER! That's why Afena is committed to helping members save thousands of dollars by refinancing their high-interest rate finance company loans through the credit union instead.2

To find out how Afena may be able to help you refinance your high-interest debt, please fill out the form below and a loan officer will follow up with you in the next 24-28 hours. Or, if you don't want to wait, just stop into your nearest branch today or call 765.664.8089 to talk with a loan officer. Our amazing staff is standing by and ready to help.

Don't spend another month throwing your money away on high-interest loan payments; open your eyes to refinancing at Afena.

Member Testimonials

When “Ginny” first contacted Afena Federal Credit Union to inquire about a Bridge the Gap loan, she knew it wouldn’t be enough to fix the financial mess she was in, but she was hoping it might buy her enough time to find a miracle. At the time, she was staring up from the bottom end of a grief spiral, out of options and desperate to avoid filing bankruptcy.

It wasn’t always like that. Her husband was good with money and for years he’d taken care of their finances, saving money and paying bills. When he passed away three years ago, Ginny was devastated. Suddenly alone, she was consumed with grief and overwhelmed by responsibilities.

After paying off their home, Ginny was desperate to find a way to numb the pain...Her anesthetic of choice? Spending money. “I just went a little crazy and was spending money on just anything to get my mind off of everything. I traveled, I went to casinos,” she says. Her voice hangs heavy with regret. “And then I just got myself in so deep that I couldn’t get out. And the two places where I banked at the time wouldn’t help me.”

To finance her lifestyle, Ginny had taken out loans with finance companies and had racked up debt on several credit cards. When she finally “snapped out of it,” she found herself $48,000 in debt. As the bills came due, Ginny realized just how much trouble she was in. She says her finances reached a point where she was spending $1,600 a month just making the minimum monthly payments on her loans and credit cards.

“I was making my payments, but there at the end I was borrowing off my charge cards and stuff to make my payments,” she says, explaining; “I was almost to the point where I had borrowed off of everything that I had. In the next few months, I wasn’t gonna be able to make the payments because I had borrowed so much.”

Although she didn’t know how, Ginny was desperate to find a way to deal with the situation without filing bankruptcy. She says, “I really didn’t want to file bankruptcy. I mean, I could have easily, but I didn’t want to do that. I was brought up, you pay your bills...But I was almost to that point until Afena helped me.”

For Ginny, connecting with Afena Federal Credit Union turned out to be just the miracle for which she’d been looking. She started working with Sherry Dixon, a loan officer at Afena’s South branch, who was moved by her story. While it wasn’t easy, Sherry was able to do what Afena does best, get creative with lending solutions and find a way to help.

Of working with Sherry, Ginny says the process was very easy, and that she especially appreciated how considerate Sherry was of her feelings. “Oh, she was just wonderful. She made it easy for me to pay everything off and really took care of everything.” Ultimately, Afena was able to consolidate all of Ginny’s debt which lowered her monthly payments by $906 month.

“I just can’t express how much you guys have helped me. I don’t have much family and I didn’t have anywhere to go except file bankruptcy,” she says, her voice wavering. “It was my fault that I got in that trouble. I needed to get myself out of it, but I didn’t know how. Afena gave me the ability to do that, and it makes me feel good about myself.”

Tiffany had a member come in that had several credit cards and loans from finance companies all with high interest rates, paying a total of $1,520.79 a month! She was able to get their rate down to 10.95% and combine everything they owed into a personal loan with a monthly payment of $780.81 a month. Our member is now SAVING $740 A MONTH!!

Nikita had a member come in to refinance an auto loan with Afena. While looking at their credit report, she noticed several high interest loans with local finance companies. Nikita was able to move all their loans and the auto loan to Afena saving them $405 a MONTH by lowering their interest rates from as high as 37% as low as 4.99%!! Good eye, Nikita!

When L.A. (pseudonym) finally took his daughter’s advice and joined Afena Federal Credit Union in April earlier this year, he wasn’t expecting much. L.A. and his wife live in Wisconsin, where he’d been a member of a credit union for 26 years.

Shortly after refinancing his auto loan, L.A. received a call from Tiffany Burdette, Branch Manager of Afena North. The credit union had reviewed his credit report as part of a loan committee meeting, and Tiffany was curious if he would be interested in seeing if Afena could help refinance some of his high-interest debt. L.A. was interested but cautious. “I figured no one’s going to lend money to us,” he explained. He was also surprised; he’d asked his credit union in Wisconsin for help consolidating his debt and had been told no.

Most of his debt that he had when he joined Afena was from paying for cancer treatment and medicine. To get the money he needed, L.A. used credit cards and took out personal loans at One Main Financial three other finance companies. At the time, it seemed like a fast convenient alternative to borrowing from his credit union in Wisconsin.

He credits Afena with opening his eyes to how much money he was wasting by borrowing from finance companies that loan money to customers at a higher interest rates than they actually deserve. Early on, L.A. was asked to find out what the interest rates were on his finance company loans and call back to let Tiffany know. He was shocked at what he learned. “I was paying $190 a month and one loan. But the interest rate was 108%. So actually, I was only paying $82 towards principle.”

Thanks to Afena, L.A. was able to consolidate all almost of his debt into a single $36,000 loan, which saved him money and substantially improved his financial situation. “When they offered me the loan, I was able to pay off everybody except One Main. I still pay them $322 a month. But now I have $1,400 extra dollars in my bank account every month. That’s how much money I saved refinancing my debt with Afena.”

L.A. credits Afena, especially Tiffany, for going above and beyond to help him get into a better financial position.“We decided to come down to meet Tiffany in person to sign the papers, and that’s exactly what we did. And believe me, it really made us a lot better financially. I belonged to a credit union for 26 years here in Wisconsin and they couldn’t help us at all. But Afena took a chance on us, and of course, we’re not going to let them down.”

Despite living in Wisconsin, he is eligible for membership because he has an immediate family member who is a member of Afena...a benefit of which he plans to take full advantage. “You guys are going to be there for us until the day I die.”

Be our next member testimonial! Contact Afena today to find out how we can help you!

1. Afena Federal Credit Union is not affiliated with, or acting on behalf of, either One Main Financial or Mariner Finance. 2) All loans subject to underwriting guidelines.